Public:ARHUDFM FAQ

Furtherium UG / Furtherium Inc.

Frequently Asked Questions

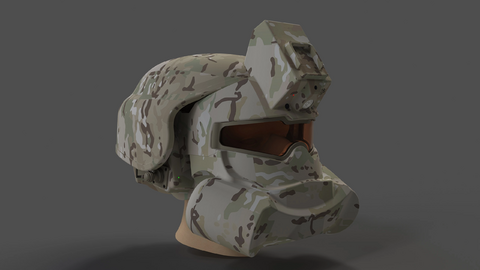

Description of the most frequent questions and answers regarding the Startup, founders, the problems, the solutions, the market, competitors, available technologies, business models, development and growth stages, risk assessment, financial models, unit economics and strategy for the project ARHUDFM: Augmented Reality Head-Up Display Fullface Mask

Revised on July 31, 2023

Notes:

- All questions related to description of the application, features, and main characteristics of the upcoming electronic device ARHUDFM: Augmented Reality Head-Up Display Fullface Mask can be found in the public ARHUDFM Features Summary of our Wiki at https://wiki.furtherium.com

- This is the printed version of the electronic document located at https://wiki.furtherium.com/wiki/Public:ARHUDFM_FAQ

Please contact Basil Boluk at basil.boluk@furtherium.com if you have any questions or comments.

Furtherium on Vulcan Defense Innovation Technology Scouting Platform, sponsored by USSOCOM, fully networked solution on GovCloud(US).

DUNS: 030938614

CAGE: 9AMZ2

Abstract

![]() →redirect Further information: Public:ARHUDFM Manifesto, Public:Applications, Public:ARHUDFM Features Summary, Public:DoD_Pains, Public:Graphical User Interface

→redirect Further information: Public:ARHUDFM Manifesto, Public:Applications, Public:ARHUDFM Features Summary, Public:DoD_Pains, Public:Graphical User Interface

Problem

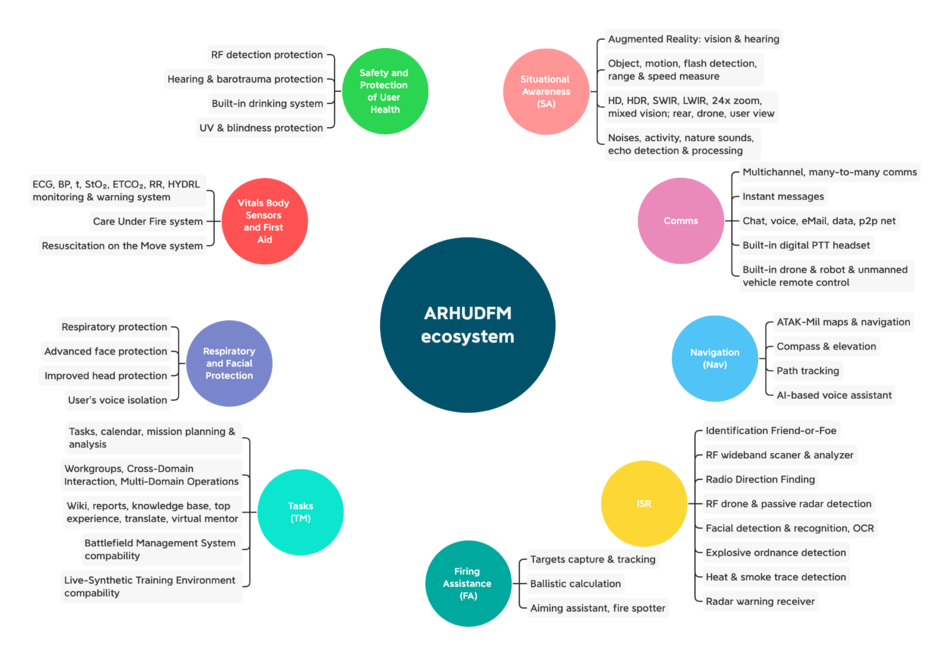

Deficiencies of the human systems used in the U.S. and German armed forces and in NATO: a distributed communication between units and between all warfighters, orientation and navigation considering fast dynamic environmental factors, the effect on concentration when performing multiple simultaneous actions, disadvantages of portable wearable devices, a lack of important additional electronic functions, a high cost of modern equipment.

Actual transformation areas and new capabilitites:

- Situational Awareness (SA)

- Communication (Comms)

- Navigation (Nav)

- Intelligence, Surveillance, Reconnaissance (ISR)

- Firing Assistance (FA)

- Task Management Tools (TM)

- Respiratory and Facial Protection

- Safety and Protection of User Health

- Vitals Body Sensors and First Aid

Several problems and strategic capabilities at once.

1. Distributed communication between units and between all soldiers:

- Quality of communication

- Voice communication with the enemy at a distance

- Encryption

- Simultaneous communication through multiple channels

- Accuracy of information and communication

- Duration of communication sessions

As a rule, the commanders of the units have digital remote communication devices with encryption algorithms, 2-channel or 4-channel wideband, data transmission at fixed and hopping frequencies. However, most of those involved have simpler radios that are jammed by electronic warfare or suffer interference in terrain with terrain elevation changes. In addition, if the unit is performing tasks in small groups, it lacks communications with other command centers, much less other domains. Voice information is exchanged through nodes, which slows down communication considerably. An important point is certainly the fact that voice communication between NATO units from different countries encounters language barriers.

The solution is a software-defined radio (SDR2) embedded in an augmented reality mask that operates flexibly on an extended frequency bandwidth with multiple waveforms and modulations, directional antenna and with less transmit power. The result is less interference with others and communication errors, more workarounds for radio jamming, and increased transmission range. Multi-channel one-to-many communication shortens the duration of sessions and the speed of data exchange, especially for short text and character messages, graphics, and GPS position exchange. This improves communication and coordination many times over.

Loud communication with the enemy or the population by each fighter avoids misunderstandings.

2. Orientation and navigation considering fast dynamic environmental factors:

- Friend-or-foe system (warfighters, vehicles, drones, robots)

- Speed of map reading and positioning

- Exchange of positions within the same unit and especially during inter-domain interaction

- Capture of enemy fire positions and missile launch positions, approach to distant objects, and object recognition

The friend-or-foe system is still a prospective system for all Alliance countries and is not yet widely used. It is not effective without the use of augmented reality technologies. Another problem is the need for rapid target acquisition in the field and real-time navigation with the ability to see the positions of friendly units and vehicles, as well as captured fire positions and enemy movements, detect heat and smoke trails, and distinguish

between civilians. This requires receiving data from the drone and from other friendly units.

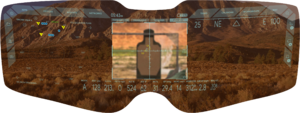

The navigation grid should show not only the landscape but also the distance and movement path of friendly and enemy positions, their numbers, and identification codes for communication. The optical ability to zoom in on distant objects, object recognition using computer vision and identification with satellite imagery or electronic maps and day and night thermographic vision combined with optical and infrared spectral vision must be available at all times.

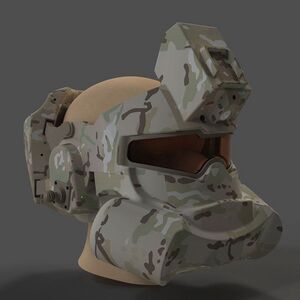

It is important that soldiers are not distracted by these tasks and do not lose sight of their surroundings while using other equipment (navigation device, tablet PC, map, binoculars, rangefinder, thermal imaging camera, radio, and night vision device). All devices should be integrated and not interfere with observation.

3. The effect on concentration when performing multiple simultaneous actions:

- Observation, detection, and approval

- Execution of the combat task

- Delegating the task to another

- Ballistic measurement and target setting

- Reporting the execution of the task

- Monitoring the execution of the task by others

- Screen view, text input

It is rare for a human to be able to provide two or more thought processes at the same time. For this reason, Air Force pilots have long used the head-up display to show important navigation parameters and target data. Progress and new possibilities overwhelm a person's cognitive abilities. In every domain, including sea and land, the military first conducts surveillance. Immediately upon detection, they must decide if data needs to be shared or if the electronic system needs to take care of it by providing updates to others. If the information is important, confirmation of data sharing should be obtained and possibly coordinated with others.

Whether a combat task must be delegated to or by others, or the decision has been made to perform it oneself, a very simple, clear, and immediate protocol for coordination is required. And an equally simple and concise confirmation of the established outcome. One solution is the use of voice control, auto-tracking, and data exchange via radio communication with symbols, graphics, and written codes.

Another important task that overtaxes a person's cognitive abilities is calculating ballistic parameters and aiming. It does not matter whether the weapon is a handgun, a rifle, a machine gun, a mortar or an artillery piece. The computer calculates 7 to 12 parameters in milliseconds, often with pre-positioning and corrections, saving time and ammunition.

4. Disadvantages of portable devices:

- Dimensions and weight

- Lack of comfort during prolonged wear (pressure on head and face, fogging of goggles and visor, insufficient ventilation of head and face, battery charge)

- Wired communication between devices on the head, back, waist, and chest

- Visibility to the enemy when using glow screens at night

- Lack of integration of the different systems - respirator, face shield, night vision, drinking system, voice communication - into each other

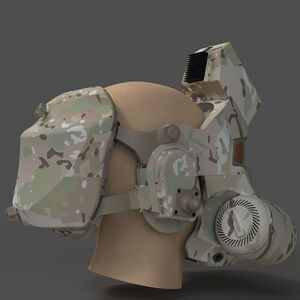

Several different electronic devices must be combined into one, and in doing so, weight and dimensions must be reduced, and freedom of movement must not be restricted. Cables that disturb and endanger the soldier must be inside the devices. High-strength materials and component resistance to water, dust, heat, cold, shock, and vibration should enable the performance of all combat missions. When wearing the device for extended periods, the comfort of the wearer must be ensured. This includes easy breathing through the mask for more than 24 hours, sufficient ventilation of the head and face, and pressure on the soft tissues of the head that does not affect the blood supply. The visor must be protected against fogging. The operating time with a single battery must be more than 24 hours. A drinking system must be built into the mask. The mask must have a ballistic helmet suspension system that can be easily attached and removed with one hand.

The soldier must not be visible at night because of the glowing screen. During the day, the visor must not dazzle in the sun. An important technical solution for the modern soldier's equipment is also the integration of respiratory protection, face protection, visual protection, an integrated drinking system, night vision, and all kinds of communication. In this way, it is equipped for combat operations in different environments and under different threats for long periods of time.

5. Lack of important additional electronic functions:

- Written encrypted communication

- Silent voice communication (acoustic voice isolation)

- Real-time transmission and viewing of images from the drone or robot on each participant's screen

- Transmission and viewing of images from external devices outside the body contour

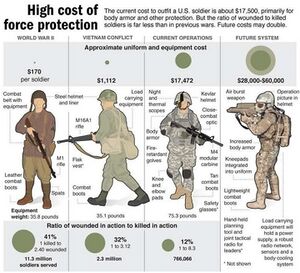

6. High cost of modern equipment:

- Night vision binoculars and night vision sight

- Thermographic sight

- Optical binoculars and rangefinders

- Handheld portable radio

- Tactical headset

- Navigation device and compass

- Respiratory protection, face protection, and hearing protection

- Helmet and body protection

- Uniforms, footwear, equipment, ammunition

- Armament and first aid equipment

Key factors for Cross-Domain Interaction (CDI)

So the main factors for the CDI concept should be -

- A multiplication of communication through secure communication protocols, not through increased voice communication, but through the exchange of digital data about positions, events, tasks, and execution reports. Primarily written, symbolic, and graphical data that requires less traffic is more objective and understandable in a multilingual environment and is more easily processed by machines, including artificial intelligence (AI).

- The role of a tactical unit commander should not include the role of a communications center. They can focus more on unit coordination. Communication hubs are now machines.

- On the other hand, by following AGILE principles, each combatant, without having to expend additional forces, will not only be able to be a valuable source of data for all levels of command, but also, based on a broader range of processed objective information from other sources, including drones, satellites, and radars, presented in concise form, will be able to make more effective decisions independently without waiting for unnecessary approvals.

- The split between multichannel and machine processing will reduce channel congestion problems and increase the speed of exchanges and decision-making.

- In addition, the fighter's local cognitive superpowers, which are also processed by machines, will enable them to see, hear, and recognize what was previously inaccessible to most people at a lower level. This enables an immediate response both to themselves and to other participants in the same domain and in other domains.

The development of such Cross-Domain Solutions requires:

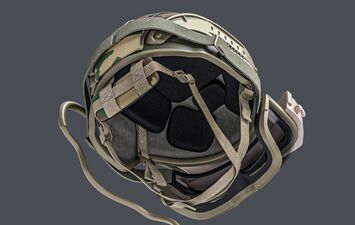

- Wearable individual helmets with head-up display, sensors, computing modules, SDR, and WLAN

- Adapted protocols for secure multi-channel communication

- New protocols for interaction and decision-making at all levels in various domains, including AI algorithms for big data analysis

- New training protocols for fighters, gunners, technicians, engineers, pilots, and commanders using virtualization technology

-

Wearable individual helmets

-

Adapted protocols for secure communication

-

New protocols for interaction

-

New training protocols

In addition, several strategic opportunities are also part of the problem. In the constant competition for superiority over a potential enemy, this is an important element of the problem assessment.

7. Visual communication:

- Exchange of digital position data for fast navigation

- Exchange of symbolic data for quick understanding

- Exchange of graphical information from drones and robots, a transmission of camera images to other units and participants

The location of positions and probable positions are success factors in tactical tasks. However, since the positions of friendly and enemy units can change unpredictably and very quickly, commanders do not always have complete and detailed information, especially for smaller units. It is important that each warrior in each squad group knows in advance what environment he will be in one hour. The most important thing is to be able to distinguish between friendly and enemy units before contact occurs. The concept of "friendly fire" should be abandoned. It is also important to support allied units that are suddenly ambushed and urgently need help from nearby units.

In order to report and receive the information for such navigation in real-time, it must be displayed exclusively in graphical form. It is even more convenient to have the navigation grid constantly in front of one's eyes without disturbing the overall view. The same applies to information collected not only by humans but also by drones. Part of the reconnaissance information must be processed in real-time and forwarded via common channels to

everyone within a certain radius.

- Close airspace surveillance, hostile and friendly drones detection

- Enemy firing ranges

- Heat and smoke trails from missile trajectories with an estimation of launch positions

- Faces and objects from a distance

Modern computer vision systems are able to detect objects faster and better than humans by comparing them to previous images. Once an activity has been detected, the machines can analyze firearm flashes, aircraft trajectories, vehicle movements, and ballistic trajectories, as well as examine the heat and smoke trail of missiles in real-time and with high accuracy.

Neural networks can learn very quickly from a relevant data set. The more data, the more accurate the analysis. Progress with these technologies is measured in months, not years. As a rule, high image sharpness is not required for accurate recognition and the algorithms work efficiently even with images and videos of average quality.

Another area for recognition using computer vision is human faces. When patrolling and interacting with civilians, it is important to be able to recognize terrorists and enemy soldiers in civilian clothing. Emotion recognition capabilities are particularly noteworthy. Every human emotion has a wide range of gradations. Beyond that, however, it is usually important to evaluate the combination of emotions.

9. Noise filtering and detection for better orientation and observation

Human hearing is many times less informative than that of animals. At the same time, external microphones and bandpass filters have long been able to pick up and isolate individual sounds, even quiet ones. But this used to be the competence of sound engineers with good experience and developed hearing.

Neural networks are now quickly trained to recognize the right sounds and noises and transmit the results quickly. And it doesn't require much computing power. In practice, such super capabilities as part of a soldier's personal kit will enable even inexperienced personnel to perform reconnaissance tasks much more effectively.

9. Electronic management of tasks (automatic tracking, delegation, proof of completion)

The next technology, which has long been used for civilian purposes, is auto-tracking. The system uses sensors to record the result itself and sends an automatic report on execution without requiring human intervention. This can be taking a position, suppressing enemy fire, leaving the firing zone, apprehending the enemy, recording patrol results, and many other tasks that will not require human intervention. Each soldier just needs to have a computer and turn it on.

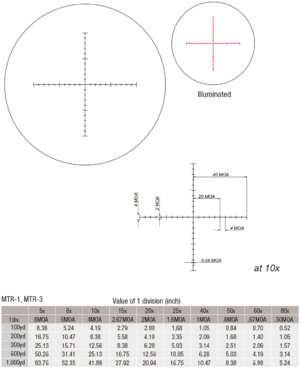

10. Electronic ballistic calculation, aiming assistance and correction, instant exchange of enemy positions, and distributed target control

Ballistic calculations have been performed by specialists for decades. And for many sophisticated weapons, computer calculations have also been used for a long time. However, for soldiers not sitting in front of a fire control monitor, for small arms, including snipers, for machine gunners and grenade launchers, for mortar fire, ballistic calculation functions and aids in aiming as well as correction can be useful. Ballistic calculations often use more than 20 parameters, such as range, target location angle (sight line height), wind speed and direction, upward air flows, temperature, relative humidity, precipitation, altitude, barometric pressure, caliber, and type of ballistic projectile. In addition, there are a number of other factors that are rarely considered.

Since the calculation of distances over 400 meters is already a complex task, it is difficult to solve it simply in your head. It is common for professionals to be trained to use tables and correction tables. A computer algorithm makes it possible to use much more accurate results of numerical integration of a system of differential equations. Another task that can be done better with a high-tech assistant is aiming. When not shooting from a closed position, it is much easier for a person to use a digital laser pointer sight integrated into an augmented reality helmet. The shooter aims the laser's crosshairs at the target and, taking corrections into account, immediately sees the likely point of impact.

Business Model

We will work on the basis of two models: Sales and SaaS for application functional modules. Due to the fact that various agencies and military-technical corporations have shown interest in our product, we are planning direct sales in collaboration with them, less likely through direct tenders.

This is a B2B and B2G area. This metric can be double-edged here. If you estimate the cost of a pilot program, CAC could be $120K-160K.

Still, I think there should be more focus on LTV (lifetime value of customer). I assume LTV of customer averages over $400M.

The project is currently at the prototyping stage.

Competition

Neither now nor in the future are we afraid of competition. First, competitors help us to keep a good tone and pace in the work of product development and customer support. Secondly, no competitor is capable of taking a dominant position in this market. Thirdly, none of the experts have any doubts about the great growth potential of the market for years to come.

Currently I would mention the following: Microsoft, L3Harris Technologies, C5ISR CCDC (DEVCOM), DARPA, Red 6 & Lockheed Martin, Elbit Systems, BAE Systems, Airbus Defense, Smart Shooter, Magic Leap. However, all except Microsoft are either developing an irrelevant product or there has been no confirmation for at least 4 years. We have been researching competitor information regularly for over 2 years.

I see more potential in smaller teams than in the giants. The list of reasons is very long. The main ones are the ability to dive deep into problems and come up with a solution that fits the problems perfectly. If you don't try to invent from the beginning, and adapt a completely different product that hasn't taken off in the B2C market, that's not a good strategy.

It will be a slower path. This is the example Microsoft shows. They are already in their third year of spending the money received under the DoD contract, and news about the IVAS program appears less and less frequently, mostly negative. If you analyze other sectors of the defense technology market, in most cases the new contracts go to medium and even small companies, not to large companies. Big business then seeks to acquire these companies in order to maintain its market share.

Now we can only talk about the future. Because neither we nor our competitors have ready-made products for relevant competitive comparison.

Critical functions

- Active device cooling even at high air temperatures

- Battery life over 72 hours

- No external wiring and modules

- Variable transparency of the central part of the visor

- Built-in respiratory and facial protection from gases, aerosols, dust, bacteria and viruses

- Built-in hands-free drinking system

- Voice and hand tracking control

- Joystick control and virtual keyboard

- Oxygen level, heart rate, body temperature, hydration level sensors (vital body sensors)

- Built-in VHF / UHF band radio

- Built-in SDR (Software Defined Radio) for digital encrypted one-to-many communication

- Written, symbolic and graphical communications for fast and accurate exchange

- Friend-or-foe identification

- Automatic capture, tracking and transmission of enemy positions, incl. out-of-sight (RDF), to other users and HQs

- Auto-tracking of own positions and execution of tasks

- Digital zoom and measurement

- Night vision (passive only terrain perception, with no IR source visible to others)

- Drone and external cameras view

- Digital aiming system integration

- Rear view

- Ballistic calculations and target hit tracking and corrections

User friendliness

- Active head (under-helmet) ventilation, an extremely valuable feature in a heat of a outfit while on a move, when sweat pours into eyes

- Low breathing resistance of respiratory protection for comfort during prolonged use and high physical exertion

- Acoustic isolation of user speech

- Reduced visibility in the infrared spectrum thermal imaging cameras

- Low pressure on soft tissues of face and head

- External loudspeaker is needed for comfortable voice messaging to people without the device over longer distances or in high noise environments

- Built-in bright light source with adjustable brightness to illuminate the space and work area in front of the user

- Convenient written task system, automatic task control and checklists

- Comfortable system of symbolic communications (analogue of road signs), coupled with an AI system

- Real-time access to library and reference materials

- Accurate shooting with both eyes open

Expanded functionality

- Connectivity with C4I, STE One World Terrain (OWT), ATAK-MIL systems

- Distributed p2p computing when running neural networks for complex AI, ML, CV tasks (integrating the resources of tens and hundreds of users)

- LiDAR connection (NVG mount, USB) for visibility in conditions inaccessible to IR and optical systems

- Passive radar connection (NVG mount, USB)

- External active phased radar connection (remote mobile radar, UAV equipped with radar)

- Missile engines heat & smoke traces (Computer Vision)

- Motion and flashes detection (Computer Vision)

- Face and object recognition (Computer Vision)

- Ambient sound filter (ISR tasks, Machine Learning)

- Training in a mixed Live-Synthetic Environment

Price

- We expect to price the product at an average of $3,400 plus an annual software subscription of $1,440. With an average amortization period of 3-5 years, our revenue per user would be $7,720-9,160.

- The ENVG-B Goggle from L3Harris is priced at $25,400.

- The price of the IVAS from Microsoft is over $55,000.

These are mostly intellectual barriers. Because the cost of development is relatively not high. If a team of like-minded people is gathered for development and if modern development methods are applied in practice, not in words.

Another barrier can be market entry. But in the U.S. alone, there are more than two dozen decision-making centers for a pilot program and contracting. And besides the U.S., there are at least 23 other countries on our list. The total is more than 150 decision-making centers. If we do not take into account the areas of civilian applications (police, security services, firefighters, rescue workers, paramedics). There are already several thousand decision-making centers.

Competitive Advantage

We have a modest opinion of ourselves. I know from experience that my ideas and projects in the past have now found massive validation. My natural curiosity and desire to get to the root cause help me. I also appreciate the broad erudition that our co-founders have. And, of course, great patience to complete many routine tasks that often cannot be closed quickly.

We do not manufacture the components and materials from which the product is created. We do not develop frameworks or software technologies. We invent new designs, develop new electronic circuits and printed circuit boards, develop new technologies for user tasks and new algorithms for software code.

On the contrary, several say they doing. We have confirmation only about the IVAS project from Microsoft. These problems have been discussed at conferences for more than 10 years, the problems are not new. However, previously the level of technology did not allow to create such a product. Now it is possible for many. And I am sure that within a few years, several dozen companies will offer their solutions, and the market will choose the best 10-15 of them.

Our main advantage is that we make a product that meets the needs of users much better, has more prospects for expanding functionality and costs at least 30% less than Microsoft IVAS and L3Harris ENVG-B.

A little above in the question "Compared to your competition, how do you compete with respect to price, features, and performance?" we detail the differences in features and price.

We try to be clear to everyone with whom we discuss the project. With military and security experts, with technical experts and founders of other startups. We get feedback that the problem is clear, the solution fits the problem.

We have a great imagination and can feel things that aren't there yet.

Our product comprehensively solves several problems simultaneously. Whereas our competitors have a solution for one or two problems at most. We were also very careful about long-term comfort, power consumption and battery life, and ensuring sufficient cooling. We pay special attention to the future user experience in the interface, controls, and the application algorithms themselves.

Customer

Customers want first and foremost to solve problems of Cross-Domain Interaction and Situational Awareness. They also want advanced digital vision and hearing capabilities, digital assistants for instant threat response and for combat tasks - ballistic calculations, aiming, correcting, and sharing enemy positions. In a few words, customers want to save more lives of military personnel and give them a greater advantage over the enemy. This applies not only to the military, but also to the police, public and private security services, firefighters and rescue workers.

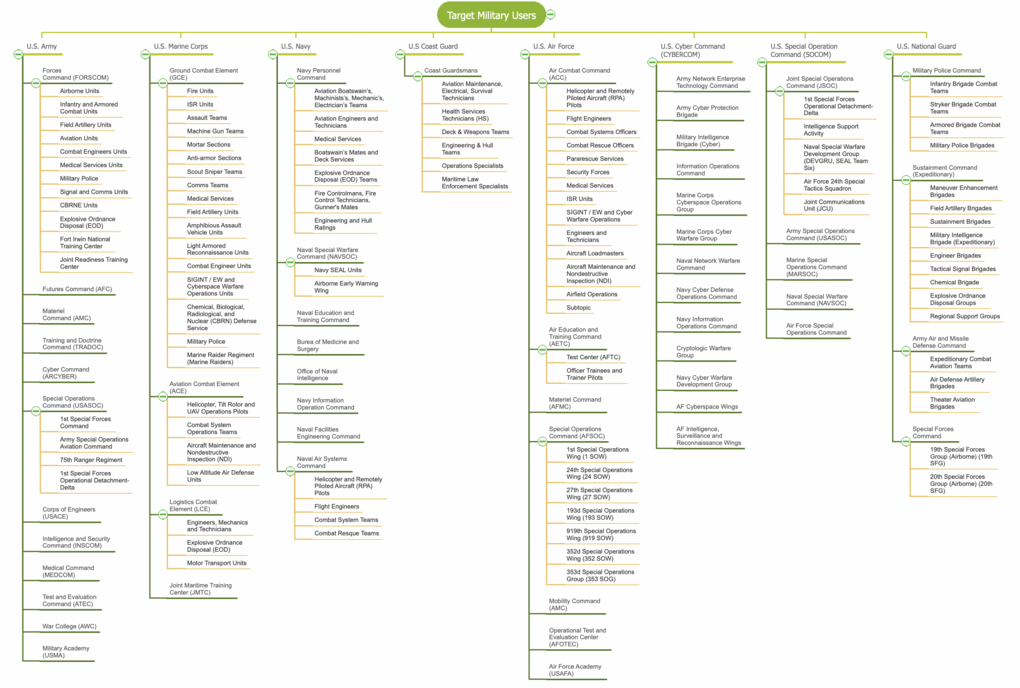

Military

- Army and Marine Corps operational units

- Army and Marine Corps reconnaissance teams

- Special operations forces, rangers, navy seals, airborne

- Patrol and cover units

- Military engineers and EOD units (sappers)

- Snipers and fire spotters

- Machine gunners and grenade launchers

- Mortar crews

- Artillery crews

- Combat vehicle and tank crews

- National Guard operational units

- Military personnel of Navy ships combat units

- Military personnel of Navy ships technical units

- Deck services of aircraft carriers

- Patrol services of aircraft, naval, regional forces bases

- Operational units of military police

- Paramedics and doctors of medical service, surgeons

There are more than 1,664,000 U.S. troops, 1,561,000 troops of other NATO countries and 1,045,000 troops of allied countries (Israel, Japan and South Korea).

Civilian services

- Coast Guard cutter and ship units

- Customs and Border protection units

- Immigration and Customs Enforcement units

- Police, Sheriff's, SWAT, FBI, DEA, ATF, USSS, USMS operational units

- Police and Sheriff's patrol services

- Patrol services of private security companies

- Professional and volunteer firefighting crews

- Civilian paramedics, doctors and surgeons

The number of police and security officers in the U.S., the EU, the U.K., Israel, Japan, and South Korea exceeds 3,075,000. Even more private security personnel. The number of firefighters in these countries exceeds 4,839,000. The number of surgeries and emergency medical technicians exceeds 1,035,000 and over 1,100,000 private security guards in the U.S. only

Countries

- United States

- United Kingdom

- Canada

- Germany

- Netherlands

- Belgium

- France

- Spain

- Italy

- Denmark

- Norway

- Sweden

- Finland

- Czech Rep.

- Slovakia

- Poland

- Romania

- Slovenia

- Portugal

- Switzerland

- Greece

- Israel

- Japan

- South Korea

Over the past 10 years, the DoD and military experts have developed a clear image and vision for the future in human tactical systems and Cross-Domain Interaction. But there are no ready-made offerings on the market yet. We are aiming for “the blue ocean”.

The project's traction to date includes several Problem-Solution Fit confirmations from U.S. DoD, DARPA, DIU, Lockheed Martin, Bundeswehr and prototype development.

Soldiers and officers who perform tactical combat missions in different combat units in different branches of service: Army, Marine Corps, Navy, Air Force, National Guard, Coast Guard, Border Guard, Customs Service, Medical Service, Military Police, Federal, and Municipal Police, FBI, DEA, ATF, USSS, USMS, Fire Departments, Private Security Services, as well as technical officers of warships, boats, helicopters, combat vehicles, and tanks.

Resistance is inevitable. It is a new experience. However, success depends on the strategy and quality of preparation for the field test. Particularly among U.S. DoD military experts, military-technical corporations and the Bundeswehr, with whom we are already in contact, we see approval and support for our decisions. We expect to jointly develop effective protocols and goals by the time the field test begins so that they are achievable. After that, we will work together with great care to prepare pilot programs and collect user opinions so that we can make the necessary changes in time, but not to allow distractions from the main goals of the solution. The user experience will decide.

There are many agencies that research and develop new human systems for the military, innovative projects and programs to collaborate with small and medium-sized businesses. First and foremost, however, we will rely on the existing channels of military-technical corporations that have extensive experience with contracts with defense and security departments and have a good reputation.

Briefly, customers want to increase the safety and at the same time the efficiency of their employees, create an advantage over the enemy, reduce operations time and stress, provide more comfort and improve communication for the best control of the situation. And they also want to reduce the material costs of ammunition, equipment and the number of combat units used.

We have been doing research for more than two years. We read publications by military and security experts, publications by military conferences, publications and reviews by military bloggers (former military personnel), watch tactical videos, evaluate the opinions of military and technical corporation personnel, and analyze the research programs of military agencies such as DARPA, DEVCOM, ARL, AFRL, AFC, CERDEC, DIU etc.

We hope that the first paying customer will be one of the military-technical corporations with which we are negotiating a collaboration.

Much has been written and said about customer problems. In different countries, the community of military and security experts is united in its opinion. We have received several confirmations of Problem-Solution Fit from Army xTechSearch’6 of U.S. DoD, Defence Innovation Unit of U.S. DoD, DARPA DSO, Lockheed Martin Co. VTC Systems, Planungsamt der Bundeswehr (Abteilung I).

I think the interest is related to the relevance of the problem and the uniqueness of the solution.

We deal with large agencies and corporations. We don't always get answers to our appeals. It often happens that communication channels are very overloaded. And direct appeals to key employees become effective, bypassing the primary filter of less motivated lower-ranking employees. Sometimes it works to mention famous names that have made the first step towards us. Sometimes the contact succeeds on the third or even ninth attempt. Lots of reasons. We strive to be flexible and persistent, but avoiding intrusiveness.

Financials

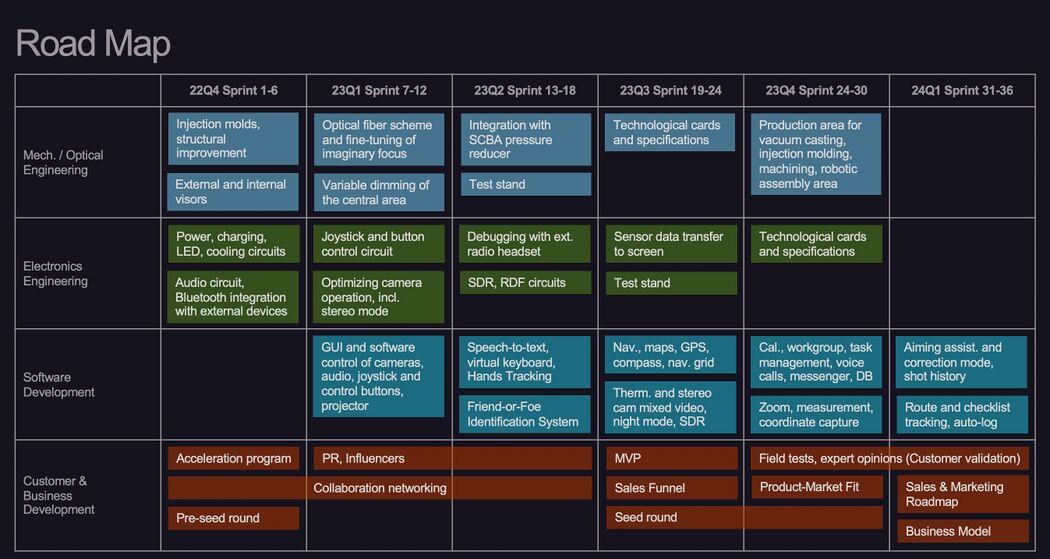

During this year, about $4,000 a month. However, this is only the cost of materials and services of a two-person team. We need to significantly increase the team and budget in order to multiply the pace of development according to our roadmap. Nevertheless, we now have all the necessary equipment and materials for prototyping (MVP Alpha).

We need the next 18 months for MVP (Beta) development, lab tests and field trials. Immediately after that we are planning a pilot series production. Our estimated budget for the first year (next 12 months after) of the production phase after MVP Beta (MMP) are as follows:

| Budget item | Amount |

|---|---|

| 1st annual revenue (devices) | $24,570,000 |

| 1st annual revenue (SaaS subscribes) | $26,210,000 |

| Variable costs (devices) | $14,010,000 |

| Marketing total costs | $4,000,000 |

| Personnel | $2,040,000 |

| Operating costs | $520,000 |

| Equipment | $190,000 |

| Rental and leasing | $360,000 |

| EBITDA | $29,660,000 |

| Taxes | $9,790,000 |

| Net income | $19,870,000 |

| Budget item | Amount | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|---|---|

| production, pcs | 18,200 | 1,300 | 2,600 | 5,200 | 9,100 |

| number of subscriptions | 18,200 | 1,300 | 2,600 | 5,200 | 9,100 |

In Pre-Seed round, the goal is to iterate towards first versions of the product, laboratory and field tests.

| $110,000 | 6% | Materials |

| $970,000 | 55% | Personnel |

| $600,000 | 34% | Fixed costs |

| $70,000 | 4% | Reserve |

| $1,750,000 | 100% | Pre-seed round funding |

In Seed round, the goal is the production.

| $3,000,000 | 45% | Materials |

| $1,300,000 | 19% | Marketing (cash) |

| $2,000,000 | 30% | Fixed costs |

| $400,000 | 6% | Reserve |

| $6,700,000 | 100% | Seed round funding |

| Cash flow item | Amount |

|---|---|

| Seed round investment | $6,700,000 |

| Sales cash | $48,070,000 |

| Materials | -$6,700,000 |

| Seed round investment | -$14,014,000 |

| Marketing budget (cash) | -$1,300,000 |

| Personnel budget | -$2,040,000 |

| Operating costs budget | -$520,000 |

| Equipment budget | -$190,000 |

| Rental and leasing budget | -$360,000 |

| Taxes | -$9,790,000 |

| Cash flow | $26,556,000 |

ESOP class B preferred shares (Q3 2024 - Q2 2025) - 0.798%, 86,580 shares, $200,000.

Q2 2025

$1,750,000 - Pre-Seed round

$6,700,000 - Seed round

| $1,350 | 100% | Weighted average unit price (device) |

| $770 | 57% | Direct costs |

| $205 | 15% | Indirect costs |

| $375 | 28% | Margin |

We expect the share of indirect costs to decrease over the future time due to productivity growth after the introduction of robotic injection molding, painting, assembly, and packaging lines, as well as after the introduction of the 2nd, 3rd, and 4th lines.

We did not do a unit economy calculation for the software development business process. However, we did include summary data in the revenue and expense budget and in the cash flow budget.

We will need time to fine-tune the production technology, and then to fine-tune the robotic lines.

Key metrics:

- Speed of development and testing within each sprint

- Code quality, software product performance

- Number of product iterations

- Number and estimated size of bugs

- Power consumption of electronic modules

- Compliance with R&D budget

- Quality of field test results

- Consistency with the funnel of collaboration and sales negotiation processes

- Compliance with supplier and contractor (PCB) lead times

- Timing of entry into the mechanical, molding, painting, assembly, and packaging areas

- Compliance with serial production quality

- Productivity of each area and each unit

- Production cycle time

- Amount of expenditures for rejects and business wastes

- Compliance with revenue and expense budgets and cash flow

- Compliance with minimum margins (unit economy and prices)

Fundraising

We received a $50,000 non-reimbursable grant.

The company formed share capital on the incorporation of $5,000. The company did not raise any debt funds.

We hope to raise funding during Q1 2023 - Q2 2023.

It is not possible to make an assessment at the Pre-Seed stage. We believe that the evaluation of a set of co-founder results and their future potential (with the probability of increasing the number of co-founders from 2 to 4), the evaluation of market potential, the evaluation of future market positioning, the evaluation of intangible assets, in total could amount to $25,000,000 (pre-money).

Equity

$1,750,000

$25,000,000

This is the first round of funding.

| $110,000 | 6% | Materials |

| $970,000 | 55% | Personnel |

| $600,000 | 34% | Fixed costs |

| $70,000 | 4% | Reserve |

| $1,750,000 | 100% | Pre-seed round funding |

The plan is for 18 months, during which time we intend to create 7 or more iterations of the product and software apps, test under laboratory conditions (vibration, shock, cold, heat, moisture, dust, gases, acids) and get field test results in the Army and Marine Corps. After changes based on tests, we will be ready immediately for mass production of small series and simultaneously for the construction of a robotic production line with high production capacity.

Results:

- At least 120 prototypes for Army and Marine Corps field tests in 2024.

- Opportunities to negotiate procurement contracts for mass production and regular deliveries of up to 250,000 kits within 4 years.

- Opportunities to develop the software and provide regular updates as part of the licenses in addition to procurement contracts.

Growth & Marketing

We deal with large agencies and corporations. We don't always get answers to our appeals. It often happens that communication channels are very overloaded. And direct appeals to key employees become effective, bypassing the primary filter of less motivated lower-ranking employees. Sometimes it works to mention famous names that have made the first step towards us. Sometimes the contact succeeds on the third or even ninth attempt. Lots of reasons. We strive to be flexible and persistent while avoiding intrusiveness.

I think the number of interested potential customers will be more after MVP Alpha demonstration and even more after MVP Beta.

We have several marketing channels:

- Collaborations with corporations that have a good reputation in this sector

- Direct marketing, including outgoing appeals and incoming requests from SBIR, etc.

- Influencer marketing, incl. expert opinions, participation in conferences and seminars

- Media

- Content marketing and SEO

The project has no users while it is still in the prototyping stage.

We have several marketing channels:

- collaborations with corporations that have a good reputation in this sector

- direct marketing, including outgoing appeals and incoming requests from SBIR, etc.

- Influencer marketing, incl. expert opinions, participation in conferences and seminars

- Media

- content marketing and SEO

We give priority to the defense sector because we believe that with the same amount of effort we will achieve a larger volume of orders. In the second place, we consider the area of state security and the police. In third place, we look at other emergency services, firefighters, and private security. Surgeons, dentists, and some other categories of physicians, are in fourth place.

We also give top priority to the United States, Germany, the Netherlands, and Israel. At the second level are the United Kingdom, Canada, Australia, and other EU nations. At the third level, we consider South Korea and Japan.

In the B2G distribution channel, we plan to rely primarily on collaborations with large corporations, and to a lesser extent on opportunities for direct contracts. However, in the B2B channels, including municipal purchases for police, fire and emergency services, we rely more on direct contracting opportunities.

This will be proportional to the amount of effort we have, as well as the creative potential of viral content in the future. We believe that our product has a viral effect.

Our traction does not yet include sales. However, we do have five valuable Problem-Solution Fit confirmations.

At this point, the interest is in getting to know more about the product capabilities and stage of the project.

We will be able to answer this question after we enter the market with the MMP.

For the B2G channel, we estimate CAC at $200-300K, where 90% is the cost of the pilot program. For B2B channels, depending on the customer and the size of the pilot program, the amounts can be much lower.

- A chance to find the "right" investors and mentors

- The opportunity to build a motivated, effective and professional team

- Successful field test results in different branches of the armed forces and in different countries

- Successful and profitable collaboration agreements with major corporations with the expected size of future orders

LTV per user: $12,213

- $9,160 for a 4-year amortization period (3-5 years): $3,400 (device, full set) + $1,440 (SaaS, per user / year)

- The average time served in the U.S. armed forces is somewhere between 4 and 8 years. Most people only do one contract in the military. The most popular contract is the 4-year contract. I heard that 2/3 of everyone who joins does the first term and gets out.

- $9,160 x 1 (4 years) x 2/3 + $18,320 x 2 (8 years) x 1/3 = $12,213

- Content marketing and SEO

- Influencer marketing

- Networking

- Media (PR and any SMM)

We definitely do not intend to use advertising networks (SEA) and exhibition stands.

1-2 years.

Idea

Vision

Military, police, firefighters, and physicians, have super vision, super hearing, super respiratory and facial protection, a built-in drinking system, an advanced communication system, and various digital assistants using AR, AI, voice control, and hand tracking.

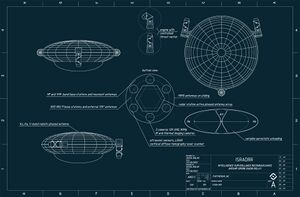

We had and still have six ideas for projects:

- Augmented Reality Head-Up Display Fullface Mask (ARHUDFM)

- Unmanned Stealth Armored Multipurpose Wheeled Vehicle (USAMWV)

- Intelligence Surveillance Reconnaissance Airship Drone with Radio Relay (ISRADRR)

- Fast Sailing Trimaran with Hydrofoils and Unmanned Control (FSTHUC)

- Remotely Operated Underwater Observation Drone (ROUOD)

- Unmanned Airships Chain for Wildfire Splinker System (UACWSS)

Each is exciting and relies on a large fast-growing market, at least $5 BN, more often $11-15 BN. There are differences in the speed of MVP development and the speed of consumer conquest.

ARHUDFM project in our opinion was and still is the most attractive because of the market potential, the ability to develop the product faster, the ability to scale production faster, and most importantly - the lowest expected level of competition.

This is necessary in the development process and to get more feedback from experts and first users. Our idea has already evolved considerably during our research and the start of prototyping.

I don't think so. We are confident in the research we have already done, and we also rely on the confirmation of several reputable sources.

If you have no empathy for this project, then could you explain what this is about. Our project, despite its military application as the dominant one, is an idea that aims to increase security around the world.

Yes, and we will continue to do so in the future.

Originally, the target audience was only firefighters, the feature set was very different, the look and internal content was different. I am sure that after several iterations of R&D, the idea of the project will still improve and become even more grounded and attractive.

Legal

We have 2 companies:

- Furtherium, Inc. (Fremont, CA)

- Furtherium UG (Ismaning near Munich, Germany)

- Furtherium, Inc. (Fremont, CA)

- Furtherium UG (Ismaning near Munich, Germany)

We already have a U.S. corporation.

Furtherium UG:

- 100% of capital by Basil Boluk

Furtherium, Inc.:

- 50% or 5,000,000 shares class A by Furtherium UG

- 25% or 2,500,000 shares class A by Basil Boluk

- 25% or 2,500,000 shares class A by Tess Volkova

No.

During the existence of the project, no one other than the two co-founders has done technical work or contributed intellectually to the project.

Furtherium, Inc. is authorized to award direct contracts with US government agencies (CAGE/NCAGE: 9AMZ2). We have no security clearance for state secrets.

4 provisional patents in progress

We have done and are doing research on existing patent protection. We will probably increase the number of patent applications and refine the patent formulas for existing ones in the future time.

All intellectual property is developed by the two co-founders of Furtherium, Inc. and is owned by that company.

No.

Market

Soldiers and officers who perform tactical combat missions in different combat units in different branches of service: Army, Marine Corps, Navy, Air Force, National Guard, Coast Guard, Border Guard, Customs Service, Medical Service, Military Police, Federal, and Municipal Police, FBI, DEA, ATF, USSS, USMS, Fire Departments, Private Security Services, as well as technical officers of warships, boats, helicopters, combat vehicles, and tanks.

A more accurate answer to this question is that this solution is needed first and foremost by senior and mid-ranking officers who plan and are responsible for the outcome of combat tactical operations, as well as public and private security managers, fire department managers, and emergency medical directors.

TAM (Total Available Market): more than 5.7M users per year.

There are more than 1,664,000 U.S. troops, 1,561,000 troops of other NATO countries and 1,045,000 troops of allied countries (Israel, Japan and South Korea).

The number of police and security officers in the U.S., the EU, the U.K., Israel, Japan, and South Korea exceeds 3,075,000. Even more private security personnel. The number of firefighters in these countries exceeds 4,839,000.

The number of surgeries and emergency medical technicians exceeds 1,035,000 and over 1,100,000 private security guards in the U.S. only.

Average lifetime of 2.5 years (the average amortization period of the product is 3-5 years).

SAM (Serviceable Available Market): more than 4.0M users per year.

SAM consists of military personnel, security officers, fire departments, medical personnel who are out of the office and do not have the comfort of a personal computer, as well as those who perform tactical, operational and rescue tasks. According to various estimates, the proportion of such personnel exceeds 70%.

SOM (Serviceable Obtainable Market): up to 1.4M kits per year or $3.92 BN. After successful field tests, contracts are awarded: 18,000 kits / 1st year production capabilities. After assembly robotization and up to 4 lines: x16 productivity or 288,000 kits / 3rd year. After launching 2nd production: x79 or 1.4M kits / 5th year. Prospective market share of 35%. The approximate weighted average price of the kit will be $2,800 (hardware + software subscribes + wear parts).

This project has a great depth of software development that allows Augmented Reality, Artificial Intelligence, Computer Vision to be used for defense and security purposes, as well as water rescue and emergency services. In addition, this technology has a large application in surgery, dentistry, sports medicine, and other medical fields where the doctor works with the patient with two hands.

We estimate that over 5 years, the amount of revenue could exceed $1,447M and the discounted cash flow (taking into account the current high inflation >6%) could exceed $656M.

Market Validation

- Military experts on active duty

- Security experts

- Advisors and consultants, retired senior officers

- Military bloggers

- Military journalists and columnists

- Defense technology scientists

- Proceedings of the Military Professionals' Conferences

- Publications in official and news media

- Interviews with senior officers, instructors, and experts

- IT trend analysis

- BAA request lists to DARPA

- Current EMail newsletters listing topics for Lockheed Martin and DARPA submissions through the SBIR program

- Analysis of corporate websites of large and medium-sized military-technical corporations

We are now seeing a return to Silicon Valley’s original culture of pioneering defense tech to protect the American homeland and its allies from adversaries. Indeed, more and more people want to work exclusively with the Pentagon and our allies on defense tech, particularly as confronting the rise of China and Russia's aggression has become one of the few truly bipartisan positions in a polarized Washington.[1]

Militaries are responding to the call. NATO announced on June 30, 2022 that it is creating a $1 billion innovation fund that will invest in early-stage startups and venture capital funds developing “priority” technologies such as artificial intelligence, big-data processing, autonomy, biotechnology and human enhancement, novel materials, energy, propulsion, and space.[2] Since the war started, the UK has launched a new AI strategy specifically for defense, and Germany has earmarked just under half a billion for research and artificial intelligence within a $100 billion cash injection to the military.[3]

NATO Allies are launching a ground-breaking initiative to sharpen the Alliance’s technological edge. Allied foreign ministers approved the Charter of the Defence Innovation Accelerator for the North Atlantic – or DIANA. “Working with the private sector and academia, Allies will ensure that we can harness the best of new technology for transatlantic security,” said NATO Secretary General Jens Stoltenberg.[4] A core function of every country is to protect and defend its people and borders. For countries like the UK, being at the forefront of innovation is vital to maintaining an agile, swift, and effective defence strategy. To support this need, Amazon Web Services (AWS) is launching its first Defence Accelerator for UK based startups, and startups from Europe, Middle East, and Africa (EMEA) doing business in the UK.[5]

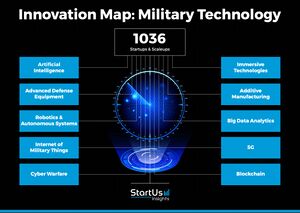

The Military & Defense Tech startups showcased in this report are only a small sample of all startups we identified through our data-driven startup scouting approach. Download the free Military Tech Innovation Report for a broad overview of the industry and research on the latest technologies and emerging solutions that will impact 2023.[6][7]

The global military apparatus is witnessing significant transformations and leveraging technology trends to strengthen capabilities. Major trends include artificial intelligence (AI), robotics, and the internet of things (IoT) to optimize defense operations and augment military efficiency. Today, conventional warfare is increasingly being replaced by hybrid approaches that also combine cyber warfare and other frontiers. Emerging military technology trends are changing the battlefield in four aspects—connectivity, lethality, autonomy, and sustainability. Connectivity solutions address concerns about how combatants detect and locate their adversaries, communicate with each other, and direct operations. Advances in missile and weapons technologies increase lethality, making battlefield operations more effective. On the autonomy front, startups utilize robotics and AI to execute decisions with zero or minimum human interference. Lastly, startups are improving sustainability in the defense industry with technologies like additive manufacturing and electrification.

United States defense startups

- TurbineOne - US-based startup TurbineOne designs a frontline perceptions system for warfighters. It utilizes machine learning (ML) to offer data-driven insights on battlefields. This includes threat detection, target identification, AI-based video analysis, and classification of killer robots. Moreover, the startup provides this data and alerts even in disconnected, intermittent, and low bandwidth (DIL) environments through a self-healing mesh protocol. This enables fighters to receive smart alerts for unseen dangers in the field without having to code or depend on the internet. - Investment round: $3M

- Onebrief - US-based startup Onebrief develops presentation software that facilitates rapid military planning, especially for joint task forces. It gathers the users’ inputs in one place, enabling them to quickly address new problems and conduct timely mission analysis using various visual tools. Onebrief also auto-updates the outputs, including briefings, sync matrices, maps, and written orders. This enables effective collaboration among the task force members. - Investment round: $500K

- Rebellion - US-based startup Rebellion builds mission-focussed AI products for the defense and security sectors. The startup uses machine learning and the power of data to deter threats and drive mission success. Their subscription-as-a-service model software products are used for achieving comprehensive battlespace awareness, executing autonomous missions, and cyber readiness. Their user-centric software designs are built on open architecture and hence are compatible with existing hardware and software systems. - Investment round: $150M

- Hermeus - US-based startup Hermeus builds Mach 5 capability aircraft. The startup’s Quarterhouse hypersonic jet is being designed to travel at a speed of 3000+ miles per hour. It uses the startup’s proprietary turbine-based combined cycle (TBCC) engine and has both military and commercial applications. The technology is capable of serving air force missions of senior leader transport, intelligence, surveillance, and reconnaissance. - Investment round: $176M

- Epirus - US-based startup Epirus develops directed energy weapons systems. It utilizes solid-state, software-defined high-power microwave technology to enable counter-electronics effects for a range of use cases. Featuring an open architecture, the product integrates with existing ground-based, maritime, and airborne systems for multi-layer protection against autonomous threats. The lightweight pods enable the destruction of critical electronic components, disabling drones. - Investment round: $288M

- Anduril - US-based startup Anduril offers an autonomous UAS for intelligent air support. The startup’s product, Ghost4, is an advanced drone system that uses edge-based AI algorithms. It is man-portable, waterproof, and has a high payload capacity as well as being able to run a variety of missions in any environment. It provides real-time surveillance, intelligence, and reconnaissance capabilities, creating a clearer common operating picture to make more informed military decisions. - Investment round: $691M

- Espre Technologies - Espre Technologies is a US-based startup that offers a suite of sensor technology products for NIN communication. The startup’s chipsets enable wireless digital encryption of data along with 10x simultaneous transmissions. The underlying technology embedded AI for smart threat detection and smart resource spectrum allocation. The network agnostic, secure & scalable communications are built for the battlefield of things and provide bidirectional communications. - Investment round: n/d

- Geosite - US-based startup Geosite aggregates data from different sources for both human and machine analysis. The startup’s collaborative military system uses satellites, the internet of things, and field sensors to build a common operating picture. Data visualization along with management dashboards offers the advantage of information superiority to plan and execute operations. It helps forces in comprehensive intel for situational awareness, tracking threats, marking ranges, and mapping target areas. - Investment round: $6.8M

- Cyber Forza - US-based startup Cyber Forza provides a unified cyber defense platform. The startup’s product has both defender and interceptor capabilities. While the former tackle external threats, the latter addresses internal threats. The platform provides AI-based distributed denial of service (DDoS). Moreover, it enables real-time monitoring, phishing fraud defense, and protection from ransomware and malware attacks. - Investment round: n/d

- GOVRED - US-based startup GOVRED builds turnkey VR-based training solutions for the military. GOVRED utilizes HTC Vive headsets and custom code to create scenarios running at 90 frames per second. This allows users to move around a 25-square meter area, interacting with multiple scenarios. The startup’s proprietary training technology provides the military with a full line of firearms training and combat simulators. - Investment round: n/d

- Red 6 - US-based startup Red 6 develops the Airborne Tactical Augmented Reality System (ATARS), a solution for AR-based combat training. The system combines AR and artificial intelligence for air combat military training applications. It brings virtual and constructive assets into the real world by allowing pilots and ground operators to see synthetic threats in real-time, outdoors, and, critically, in high-speed environments. The technology is scalable to multi-domain operations and assists squadrons in enhancing readiness and lethality. - Investment round: $40.9M

- Rapid Application Group - US-based startup Rapid Application Group produces mission-critical parts for the aerospace and defense industry. The startup provides a range of additive manufacturing solutions such as selective laser sintering, fused deposition modeling, stereolithography, digital light printing, direct metal laser sintering, and injection molding. Its application-based approach enables rapid prototyping and quality assurance of hardware parts. - Investment round: n/d

- WiGL - WiGL is a US-based startup that offers wireless electric charging via targeted energy through the air. The startup’s patented technology uses a mesh network of wireless transmitters. It converts any wall outlet, vehicle charger, or power source into a smart electric power router. Communication occurs device-to-device using 5G or Wifi. With wireless charging, IoMT devices are no longer reliant on the availability of batteries. - Investment round: n/d

- Taekion - US-based startup Taekion develops technology for military data protection. It leverages blockchain to secure defense data in tamper-proof storage. The UNIX-style distributed file system has built-in compression, encryption, and deduplication features and integrates seamlessly with existing infrastructure. The technology offers military-grade protection for information security at all levels. Moreover, the digital box feature enables forensic investigations after any cybersecurity attacks. - Investment round: n/d

- Shield AI - Manufacturer of autonomous drones for surveillance and patrolling. They have developed a deep neural network-based system to create a fully autonomous drone for battlefield applications. It delivers GPS-denied navigation, mapping, exploration, multi-robot collaboration, robot interfaces, and target detection and tracking capabilities. The company has also developed a quadcopter by leveraging its proprietary AI framework. It caters to the need of service members, law enforcement personnel, and first responders. - Investment round: $513.1M

- Dedrone - Provider of AI-based smart airspace security solutions. It comprises an array of RF sensors to detect, identify, and locate various drones in real-time, based on parameters, such as noise, shape, and movement patterns. It has a machine learning-based drone library to automate the protection of airspaces against unauthorized drones. The sensor can also be coupled with cameras to save images and videos for providing crucial evidence of the threat intrusion. It protects people, property, and information against the persistent and escalating threat of drones. - Investment round: $127.9M

- Roboteam - Provider of tactical ground robotic systems. Its product portfolio includes unmanned ground vehicles. It is a GPS-enabled wireless controller system without and with batteries. It is a throwable robotic platform with detection and tactical surveillance capabilities. It is a rugged wheeled UGV equipped with multiple sensors and which helps in route clearance for ground-based defense forces. - Investment round: $62M

- AEye - Provider of AI-enabled LiDAR sensor solutions for automobiles. It offers hardware products that are solid-state lidars with ADAS functionality. It also offers AI-enabled software for perception with features like real-time integration of pixels, predictive solutions, etc. It can be used for various sectors like defense, autonomous vehicles, etc. - Investment round: $314.1M

- Fortem Technologies - Fortem Technologies develops radar systems for detecting airborne objects and counter UAV systems for commercial and military applications. Its DroneHunter is an autonomous perimeter detection (and protection) solution, designed to detect, classify, and secure against rogue drones. On detecting an intruder drone, it uses its AI-directed detection, tracking, and guidance for remediating the air threat at a standoff distance, with no collateral damage. The company also offers a military variant of DroneHunter designed to meet the specific security requirements of the U.S. Armed Forces The counter UAV systems come equipped with TrueView which is a radar system that can be mounted on the UAV for enabling early warning of intrusive or non-cooperative air traffic. It also offers four variants of its radar solution. In addition, it provides an airspace awareness and security platform that provides a 360-degree view of the airspace, with the ability to automatically detect and deploy an autonomous counter-UAS solution to investigate, identify, and remediate threats. Fortem Technologies was spun off from ImSAR LLC, which offers its radar solutions to military clients only and was set up to provide the same radar technology to commercial drone manufacturers and software developers. - Investment round: $21.9M

- SkySafe - Provider of cloud-connected drone detection systems. It has developed airspace security solutions to detect unwanted drones. It offers airspace security with detailed event history (reference for future legal proceedings, if any) and real-time notifications. The security system can take control of a drone without using jamming technology and can safely land it. - Investment round: $45M

- Palantir Technologies - Palantir offers software applications designed for integrating, visualizing, analyzing data, and fighting fraud. Palantir revolutionizes how organizations build and deploy AI/ML by combining the enterprise data foundation with end-to-end AI/ML deployment infrastructure. - Investment round: $3BN

- C3.ai - C3 AI is a provider of Enterprise AI software for accelerating digital transformation. - Investment round: $228.5M

- Primer - Primer builds machines that can read and write, automating the analysis of very large datasets. It trawls thousands of sources online, using natural language processing to read and try to make sense of the vast amount of “open source intelligence”. - Investment round: $168M

- Slingshot Aerospace - Slingshot Aerospace applies advanced analytics, machine learning, computer vision, and collaborative tools to data from earth and space, providing customers with clarity in complex situations. - Investment round: $69.7M

- Merlin Labs - Merlin Labs develops autonomous flight system designed to be installed in existing aircraft. - Investment round: $133.5M

- Airspace Systems - Airspace provides a drone detection and disabling system. It performs multi-dimensional risk analysis by leveraging Artificial Intelligence, machine learning and advanced robotics with situational and historic data. - Investment round: $25M

- Apptronik - Apptronik specializes in human-centered robotic systems. These are robotics systems that operate in close proximity to humans. - Investment round: $14.8M

- Vannevar Labs - Developer of products for the security industry. It develops AI-based solutions for counter-terrorism missions tackling national security problems. It also uses natural language processing and caters mainly to the defense and intelligence industries. - Investment round: $12M

- Actuate - Actuate builds software that employs computer vision to automatically detect gun threats and intruders in security camera feeds. - Investment round: $13.3M

- Kraus Hamdani Aerospace - Developer of AI-enabled and electric unmanned aerial systems. The company offers stealth to radar, autonomous operations, encrypted communications, multi-constellation navigation, anti-jamming and anti-spoofing systems, and endurance systems. It also provides smart Persistent intelligence, surveillance, and reconnaissance (SP-ISR) as a service. It can be used in the defense, security, and aerospace sectors. - Investment round: n/d

- Cleo Robotics - Cleo Robotics is developing a revolutionary new drone technology designed specifically for indoor applications. The company claims to incorporate a combination of stereo vision-based SLAM and neural networks for indoor navigation and obstacle avoidance. - Investment round: $120K

- Reveal Technology - Provider of intelligent systems for the military. It offers intelligent systems for getting real-time updates in isolated areas with no updates from the headquarters. - Investment round: n/d

- Tarsier - Tarsier develops optical-based drone detection and tracking systems for commercial, government, and military users. Manufacturer of AI-based drones for defense purposes. The company claims that its proprietary artificial intelligent algorithms precisely localize and track aerial threats in real-time thereby providing the situational awareness required to defend against aerial threats. - Investment round: n/d

- HawkEye360 - One of the most defining features of today’s world is invisible to the naked eye. Increasingly, the lifeblood of the modern, digital economy is carried by the electromagnetic spectrum. Many types of objects emit radio frequencies for vital functions such as communication, navigation, and operation. At HawkEye 360, our satellites deliver a brand new data layer never before available commercially — precise mapping of radio frequency emissions. This unique ability to identify and geolocate sources of radio frequencies from space reveals previously invisible knowledge about activities around the world. Reveal the unseen with HawkEye 360’s radio frequency (RF) analytics. Use our space-based RF GEOINT to better understand the baseline of activity in your environment, quickly identify anomalous behaviors, cue other sources of intelligence, and act with confidence. Our RF GEOINT is unclassified and easy to share with partners for greater mission impact. - Investment round: $304.3M

- VOLANSI - Volansi is developing infrastructure-independent drones that can take off and land vertically, also known as VTOL (Vertical Take-off and Landing). We see a world where aerial drone delivery will expedite access to critical parts and humanitarian aid in remote locations that were once inaccessible. Our VTOL drones and logistical services make it possible for every industry to deliver anything, anywhere. - Investment round: $75.1M

- ROCKET-LAB - The satellites we build and launch are enabling innovation and exploration, they’re keeping countries connected and borders protected, they're monitoring weather and managing waste, they're providing insights on climate change, and helping us manage resources for future generations. With our Electron rocket and Photon spacecraft, we’ve simplified space, making it easy and affordable for companies, scientists, researchers, governments, entrepreneurs, and students alike, to get their ideas to orbit. We’ve opened up a solar system of possibilities for innovation, exploration and infrastructure in space to make for a better world down here on Earth. Building on Electron’s heritage, we’re developing a new 8-ton class reusable launch vehicle to deploy the constellations of the future. - Investment round: $709.4M

- Saildrone - Saildrone designs, manufactures, and operates the world’s most capable, proven, and trusted USVs. Saildrones are wind and solar-powered autonomous surface vehicles which make cost-effective ocean data collection possible at scale. We collect critical marine data, delivered in real-time, from any ocean at any time of year. We are building the world's largest high-resolution ocean data sets, working with governments and private companies around the globe. - Investment round: $189.5M

- Relativity - 3D-printed rocket startup Relativity Space. Relativity is building the first autonomous rocket factory and launch services for satellites. We are disrupting 60 years of aerospace. - Investment round: $1.3BN

- Capella Space - Capella aims to provide the most frequent, timely and high-quality SAR imagery products available, accessible through an intuitive self-serve online platform. Capella is developing an industry leading Concept of Operations that will lead to timelines not previously experienced in the earth observation industry. We want you to be able to quickly request a tasking image, collect it from our constellation and rapidly get it into your hands so you can make better decisions. We’re not the first to use SAR, but we’ve shrunk the technology tenfold to make it faster, more powerful, and affordable for the world’s decision makers. - Investment round: $179M

- ANELLO Photonics - ANELLO has developed an ultra low-loss on-chip waveguide manufacturing process with all the benefits of Optical Gyro performance integrated onto a silicon photonic circuit platform. The dimensional volume is significantly reduced compared to a traditional FOG while maintaining the low-drift in challenging environments. The integrated silicon photonics solution substantially reduces the cost compared to traditional FOGs of equivalent performance. - Investment round: $28.3M

There are 307 Military Tech startups in United States.

Israel defense startups

- Axon Vision - Israeli startup Axon Vision develops an AI-based decision-making engine. The startup’s product, edge360, uses computer vision technology to provide ground vehicles with complete and automated situational awareness. With an intuitive user interface (UI) and customized alert mechanisms, it detects, classifies, and estimates the whereabouts of threats in real time. The startup’s solution helps tactical teams navigate the threats and obstacles on the field. - Investment round: $1.5M

- Spear - Israeli startup Spear offers instant action drone-based systems. The startup’s tactical drones utilize computer vision, swarm computing, and mesh algorithms to achieve tactical superiority. The drones are suitable for instant launch from, sea, and land with both stationary and mobile platforms with a payload capacity of up to 1 kg. The drones are easy to operate and, hence, require minimal training and provide a tactical advantage to the ground and special forces. - Investment round: $17M - Uvision

- BIRD Aerosystems - Provider of airborne surveillance and missile protection systems. It provides its offerings through two market ends that are Airborne Missile Protection Systems and Airborne Surveillance, Information, and Observation solutions. Its portfolio of airborne surveillance solutions includes maritime surveillance solutions, ground surveillance solutions, border surveillance, and police surveillance solution. It also offers missile protection systems and turn-key programs that include operational analysis, system design, system integration and installation, project management, extended product support, and system engineering activities including ground testing, flight testing, and system certification. - Investment round: $40M

- D-Fend Solutions - D-Fend Solutions has developed an autonomous counter-drone perimeter security system. Claims that the system has the ability to detect, identify and intercepts intruding commercial-drones. As of March 2017, the system is in the alpha stage development and is targeting security & investigation market. Partners include RAFAEL Advanced Defense System, Nevada Institue for Autonomous Systems, RAS Consulting & Investigations, and more. - Investment round: $28M

- 4M Analytics - 4manalytics is an AI-based security intelligence solutions provider. The product offers cloud-based location intelligence solutions, remote sensing, and scouting of mine action. The product visually illustrates all the data collected, analyzed and merged, displaying the insights gained from it, using a convenient user interface and produces a digital twin of the area and situations. It classifies the suspected hazardous area according to the risk. The features of the product include data collection, data analysis & fusion, etc. - Investment round: $41M

- InfiniDome - InfiniDome provides counter-drone systems. It has a proprietary counter-drone system known as GPSdome 1.02 that provides a GPS jamming solution. It is based on Null steering technology. Its other inhouse products include GPSdome Model T that is a mountable antenna module & provides protection against jamming & spoofing of GPS systems and OtoSphere that is an add-on module to GNSS-based systems which protects it from GNSS jamming or spoofing attacks. It provides solutions for wireless communications of connected & autonomous vehicles, UAVs, and critical infrastructure from jamming and spoofing attacks. - Investment round: $5.1M

- ApolloShield - ApolloShield Anti-Drone Systems (formerly AirFence) develops a drone detection system. It involves a ground installation of radio equipment that scans for drone communication signals in its range. When a communication signal for an unauthorized drone is detected, a spoof signal that commands the drone to go out of the protected perimeter is generated and sent to the intruding drone. ApolloShield can be integrated with other systems, such as radar, audio and video-based detectors, and physical net-based disabling systems. - Investment round: $2.6M

- Third Eye Systems - Third Eye Systems is developing Artificial Intelligence-based, aEye, for drones to detect humans & suspicious objects on a pre-defined path. This pug-n-play device can be easily integrated serially and give robots/drones the ability to identify a human presence in the vicinity of its route. It records at the quality of 1080p & also features a thermal camera. - Investment round: n/d

- SkyLock - Developer of counter-drone systems for commercial and military applications. It comprises of three main components that are a 360-degree rotating radar coverage capable of detecting multiple targets simultaneously, an electro-optical system for observation, detection, recognition, and identification of drones with nighttime conditions, and a radio frequency jammer comprising several jamming antennas used to jam the frequency range of the RC and video links. For military applications, the system can be fitted with a laser burner enabling the operator to destroy a drone. The solution allows operators to prevent threats to critical infrastructures like powerplants, prisons, or areas of importance that require wide security coverage such as borders, airports, and stadiums. - Investment round: n/d

- Vorpal - Vorpal is an Isreal-based startup that develops drone detection and mitigation solutions for enterprises. Its chief offering is VigilAir which is a non-transmitting RF-based solution that detects and tracks drones by passive geolocation of their command-and-control and data transmissions thereby providing aerial situational awareness. The company claims that the solution provides zero false alarms and high accuracy even in harsh urban, congested spectral environments. It has also developed a drone-based system featuring RF sensors as a payload that interfaces with the above-mentioned product and the command-and-control center to improve the overall accuracy and coverage, pinpointing the remote-control transmission origin of the commercial drone in real-time. - Investment round: n/d - Florida-Israel Business Accelerator, Gefen Capital